James Sinclair’s Business Philosophy Part 5: Rare and protected forms of leverage

I often talk about how vital it is to run a business which has a high barrier to entry, to set you apart from everybody else.

If you have a business which has a low barrier to entry, that makes it far too easy for “me too” businesses to pop up and take a slice of your audience.

However, businesses like McDonalds, which sell hamburgers and fries, can beat other low-barrier rivals through branding alone. That is why rare and protected forms of leverage are crucial to set you apart from your competitors.

Here are the 8 main types:

1. Talent

Super successful people have these rare and protected forms of leverage, you want to get them for your business. That will help you become more profitable.

You want to have access to talent.

I’ve always liked this little story about Jeff Bezos:

Jeff worked for a big investment bank, before going to set up Amazon.

The second he set that up, he was in that investment bank and poached a load of staff to help set up his business. He chose people he knew who were really good and could get him to where he wanted to be a lot quicker.

Finding access to talent will explode the growth of your business. That’s one of the reasons why I write books and do my podcasts. I get to meet talented people who can help me grow my businesses – not just employees, but friends within the business world.

How can you get access to talent - like the best accountants, tax advisors, lawyers, bank managers, funders and employees? You must find a way to get connect with them as a rare and protected form of leverage.

2. Environment

It’s so weird that so many of the UK’s Prime Ministers came from Eton, a private school just outside London. So many talented people have come out of that school.

So many senior British politicians were forged at Eton. It’s no coincidence. (Credit: Unsplash)

That environment has created superstars of business and political success. Whether you agree with or like them or not is a different subject. But you can’t underestimate the power of your environment.

If your environment isn’t good, improve it. Get out of there and you’ll see much more success.

If you’re around billionaires, there’s a good chance you’ll become a multi-millionaire and then – eventually – a billionaire. That environment is just going to make you better.

3. Location

Where you are in the world is a rare and protected form of leverage.

I started my entertainment business when I was living in Essex, which is next door to London. I had access to this amazing marketplace.

I also look at my Rossi Ice Cream Parlour, a standalone restaurant with no neighbours, in an affluent and highly populated area. Because it’s been there for 100 years and it’s got a great location, we get customers hand over fist.

Our Rossi parlour is in a prime location on the Essex coast. (Credit: Ben Shahrabi)

If you can find a great location, a great environment, and access to talent - these are really going to help you become super successful in business.

Being next door to London has just helped me so much as an entrepreneur. I’m just very lucky to have been born in the UK.

4. Access to capital

If you have access to capital, that is a rare and protected form of leverage.

If you don’t, how are you going to get it? Is your environment good enough? Have you met the right bank managers or knocked on enough doors? Getting access to capital will give you a rare and protected form of leverage.

I always think about how Elon Musk joked he would buy Twitter, and he achieved that because he access to capital. He didn’t have that, it’s taken him time to get that.

But think about it: how can you get access to capital? Distribution.

5. Distribution

Let me give you an example of this. I’ve got an ice cream company which supplies some of the UK’s supermarkets.

What I’ve learned about owning a food manufacturing business is: the food is not as important as the distribution and transport. It’s about getting your food to people who will buy from you.

Therefore, I’m buying a food services business, just to distribute my products much more easily. That will give me a rare and protected form of leverage for my ice cream company.

It applies to most things:

If you’re producing a film and your dad owns Netflix, that distribution will help get your film out there.

If you’re a celebrity and you want to create content, that distribution is going to be so much easier than for people who are just starting out.

Access to good transport and good people to help you distribute your message are key.

Bernard Arnault, the second richest person in the world, is a distribution genius. He owns Louis Vuitton, Moet, Tiffany’s, and a host of other amazing brands.

But what he’s really good at is working out how to distribute his products.

Getting your products to people who want to buy from you is essential. (Credit: Unsplash)

If you go to most airports’ duty free businesses (all those shops you see when you get off a plane) - he owns most of those.

That distribution to put all his products into airports where people are spending lots of money is sure to help. He understands the power of distribution.

6. Fame

Even being famous to a few people is a rare and protected form of leverage. That’s so easy to do right now.

My audience is business owners that are established and want to grow their business. I’m not for people who are starting up or just want to do get-rich-quick schemes.

I want to be famous to a few people who are serious about business growth - and may want to sell their business and contact me one day.

That “fame to a few” has really helped me in business.

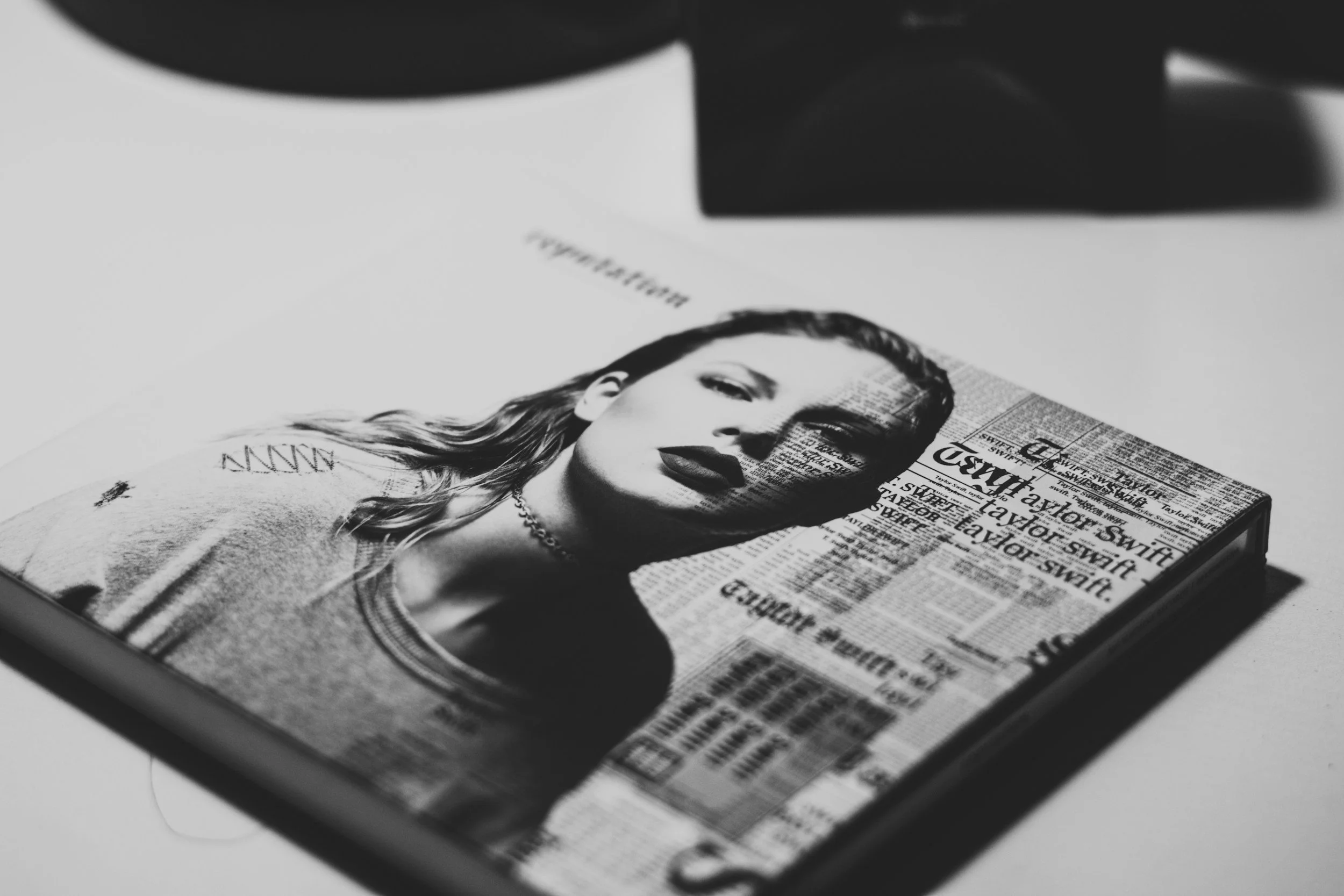

Taylor Swift is the most famous woman on the planet. (Credit: Unsplash)

But if you’re Taylor Swift, for example, you can imagine how much that fame is helping her sell out world stadium tours and all her other business escapades. Fame has definitely given her rare and protected forms of leverage.

7. Establishment

I’ve previously mentioned my hotel and 100-year-old ice cream parlour. That’s establishment.

Being a start-up business is very difficult when you’re competing against an established one – even if yours is better.

Maybe you want to create a new soft drink brand and it’s the best tasting drink in the world, you’ll find it very difficult to compete with the likes of Coca Cola which has a century behind it.

Coca Cola is an instantly-recognisable and incredibly well-established brand. (Credit: Unsplash)

Establishment is one of the biggest rare and protected forms of leverage that I’ve ever discovered.

Time in the game just helps you. Owning a 500-year-old hotel or a 100-year-old ice cream company, even if our competitors are better than us, we have a rare and protected form of leverage.

If I asked you, “What’s the biggest, oldest and most famous shop in London?”

I bet you’re thinking of two. The one that first springs to mind is Harrods, and then Selfridges. Then, you’ve really got to think hard about other shops that are so well established, like Fortnum and Mason.

That shows how much it can help you in business.

8. Brand

It’s all about predetermination in reputation.

If my iPhone breaks, I have been trained to be an Apple consumer. When it gets too old, I’m predetermined from my reputation with Apple to replace with another bleedin’ iPhone.

That’s what I love about my Rossi ice cream parlour. People are predetermined, when they go to Southend, to buy from us based on decades of previous reputation.

It is just the way human beings work.

That’s why buying companies can be so much better than starting them. I’ve made loads of videos on my YouTube channel about doing business takeovers.

Hotel chains and airlines have it, too. They only want to stay in a Hilton or fly with British Airways.

When is the best time to sell your business?

You should sell your business when it is a commercially profitable enterprise that works without you, with a brilliant management team running it.

It must make wages plus profit. If you’ve got a business which is doing £1 million revenue and makes £100,000 profit but you’re paying yourself out of the profit, that’s not a profitable business.

It it’s making £1 million profit, you pay yourself £100,000 and then it makes £100,000 profit, that’s when a business gets really good.

Remember: wages + profit

This is when it starts becoming an investment.

Never sell when you have to

Make sure you’re planning the sale of your business way into the future. Remember, you will exit the business one day – whether that’s through death or a planned approach.

Things don’t go on forever. Don’t let your exit day be your retirement day.

Plan to exit the business you’re running right now in either five or ten years.

If you then decide to carry on, that’s okay, but we want to have a finish date to build to.

That will make you a far more effective entrepreneur.